Investar is a pioneering Web3-based investment club, revolutionizing the traditional

investment landscape by harnessing the transformative power of decentralized technologies.

Within the Investar ecosystem, members seamlessly share their investment portfolios,

individual strategies, and valuable experiences, leveraging the principles of Web3 to foster

a transparent and collaborative environment.

Distinguished by its commitment to

decentralization and community-driven governance, Investar enables members to earn token

rewards based on their active contributions, including insightful opinion postings, voting,

and data sharing. Investar empowers users to actively participate in decision-making

processes, ensuring a fair and inclusive investment ecosystem.

Leveraging the

accumulated expertise of its diverse community and AI technology, Investar conducts in-depth

research on crypto investment information, analyzing market trends, and providing

personalized insights tailored to each member's preferences. This seamless integration of AI

and Web3 principles enables Investar to deliver unparalleled value to its members,

revolutionizing the way investors interact with the crypto market.

Furthermore,

Investar's commitment to decentralization extends to the processing of members' activity

data, which is transformed into meaningful insights through quant analysis. This

decentralized approach ensures that members retain ownership of their data within the

ecosystem, fostering trust and transparency.

Powered by cutting-edge AI algorithms, Investar provides comprehensive data analysis, including social data, global exchange trends, and technical indicators, enabling informed investment decisions.

Investar leverages the collective intelligence of its diverse member base, refining algorithms through continuous data analysis to enhance investment outcomes and drive the club's growth.

Through innovative AI-driven features, such as the Investment League, Investar fosters a collaborative investment environment where members can engage in social trading, showcase their performance, and earn rewards for their contributions.

Members can contribute to the Investar club and receive greater rewards by participating in the Investment League. Members with outstanding portfolios can receive direct token sponsorships from other members, with rewards increasing as interest grows.

Investar provides tools for tracking members' performance. Members can build trust and a good reputation by showcasing their strategies and performance, potentially establishing their own brand. Active leaders in copy trading can receive performance-based rewards.

Investar supports members in sharing investment ideas and posting investment-related content directly. Members can create and operate small clubs based on investment preferences or tier holdings, and Investar supports club activation with diverse content.

With gamification elements powered by AI, Investar incentivizes active participation and rewards members with tokens and exclusive NFTs, creating a dynamic and engaging investment experience.

Investar rewards members with tokens based on their club contributions at the end of each month. Members can earn activity rewards (Silver Star) for contributing to club activation and performance rewards (Gold Star) by participating in the monthly Investment League. Provides leaderboards for various categories to encourage participation.

Investar issues membership NFTs for club members, where participation in AI investment diagnosis or achieving a high ranking in the Investment League can earn specific NFTs. Limited edition NFTs can be obtained or purchased through events.

Investar's tokenomics model ensures equitable distribution and incentivizes participation, with a significant portion of tokens allocated to members for their contributions and engagement within the platform.

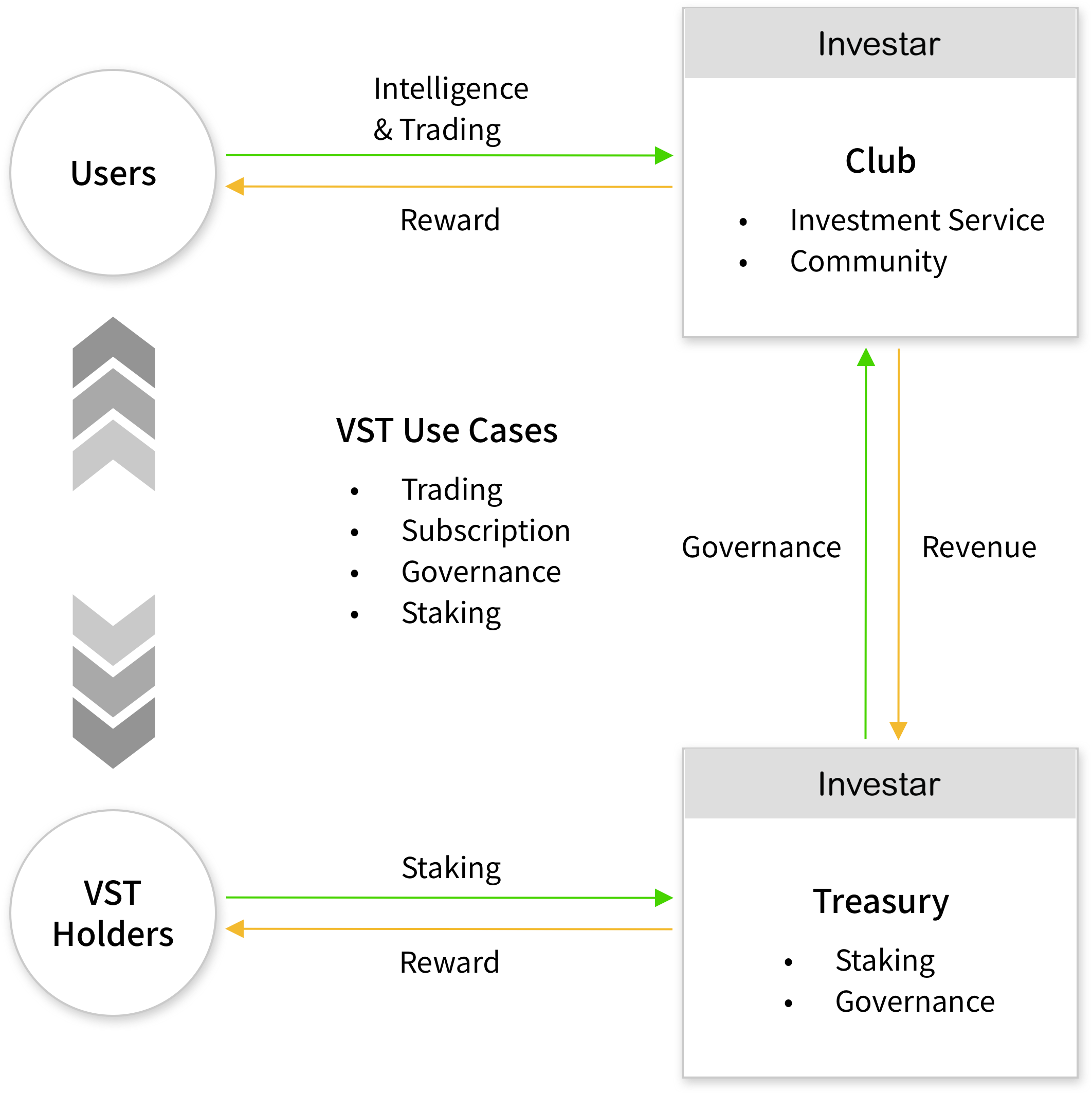

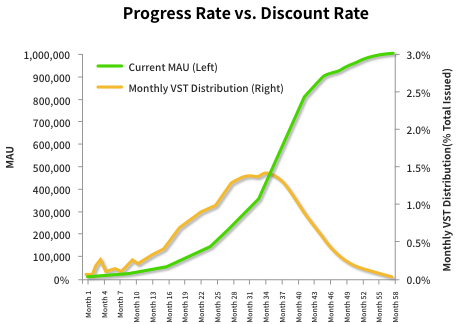

40% of the total token supply will be allocated to community members, distributed as rewards based on their monthly contributions. The distribution to members will be dynamically adjusted according to Monthly Active Users (MAU), leveraging the decentralized and transparent nature of Web3 technology to ensure fairness and inclusivity.

20% of the total token supply will be allocated to the core team, with a sequential unlocking over a period of 5 years, aligning incentives with the long-term success and growth of Investar's decentralized platform powered by Web3 principles.

10% of the total token supply will be allocated to the ecosystem fund, with a sequential unlocking over a period of 5 years. This fund will be utilized to support the development of innovative features, partnerships, and ecosystem expansion initiatives, fostering an open and collaborative environment within the Web3 ecosystem.

5% of the total token supply will be allocated to advisors, with a sequential unlocking over a period of 5 years, ensuring ongoing support and guidance from industry experts in navigating the decentralized landscape of Web3 technologies.

10% of the total token supply will be dedicated to rewarding token holders who actively engage in staking. Stakers will play a vital role in maintaining network integrity and will be rewarded with additional VST tokens proportional to their staked amount, contributing to the decentralized governance and security of Investar's Web3 infrastructure.

The remaining 15% of the total token supply is allocated for sale. The distribution proportion for public/private sales and the lock-up period will be determined at a later date, reflecting Investar's commitment to transparency and decentralization in conducting token sales within the Web3 ecosystem.

Investar will implement a robust staking mechanism, allowing token holders to stake their VST tokens to secure the network and earn rewards. Stakers will play a crucial role in decentralizing network consensus and governance, embodying the principles of Web3 technology.

VST tokens serve as the primary utility within the Investar ecosystem, providing access to premium features, participation in decentralized governance decisions, and exclusive benefits such as discounted trading fees and access to special events. Investar empowers users to actively engage and shape the future of its Web3 platform through decentralized.

To maintain a healthy token economy and incentivize scarcity, Investar may periodically implement token burning events, where a portion of the VST tokens collected from transaction fees or other sources will be permanently removed from circulation, fostering a deflationary economic model within the Web3 ecosystem.

-Star (Reward Points)

▫Members can earn stars through various activities and participation

▫Silver Star (Activity/Traffic/Intelligence Contribution Reward): Voting, referring new members, participating in AI diagnoses, providing trade insights, recommending stocks, and offering analyses

▫Gold Star (Performance Reward): Holding top portfolios, ranking high in investment leagues, etc

-Conversion of Stars to Investar Tokens

▫Members compete to accumulate more stars, and rankings are determined based on the number of stars accumulated

▫At the end of each month, based on the predetermined total token distribution, members' accumulated stars are swapped for Investar tokens

▫Wallets for receiving/holding Investar tokens are automatically generated upon registration

-Service Usage Fees

▫Receipt of transaction fees for sponsorships from other members

▫Transaction fees

▫Fees for product subscriptions/operations

▫Participation in events such as operating small clubs or purchasing limited edition NFTs

-Subscription fees for Investar Intelligence

-Advertisement fees for investment products on Investar

-Fees for account opening and transaction connections

-A portion of the costs paid by partner companies to Investar must be paid in VST. The part paid in cash is used by Investar to purchase VST and send it to the Treasury

-Sponsorship funds

-Distribution of profits from copy trading

-Conversion of 3% or more of Investar's revenue to the Treasury

-Future adjustment of the revenue-to-Treasury conversion ratio through community votes

-Reward distribution based on staking

-Distribution of 10% of the total supply according to a predefined distribution cycle

-Staking

-Voting

-Stars are awarded to members on a monthly basis

-Member rankings are determined at the end of each month based on the cumulative sum of stars

-Investar tokens are distributed according to the predetermined allocation ratio

-Stars are automatically converted to tokens at the end of each month, resetting to zero at the beginning of each month

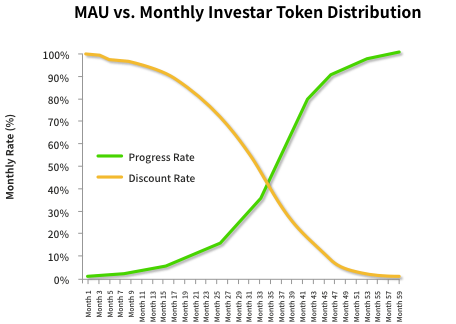

-Variables:

▫Current Monthly Active Users (MAU)

▫Current Progress Rate: Ratio of Current MAU to Target MAU

▫Current Discount Rate: Ratio of Cumulative Investar Token Distribution to the Total Target Investar Token Distribution

-Initial Boost: An initial boost aims to distribute more tokens to early members to expand the initial member base

-Target MAU: 1,000,000 members over the first two years after the platform's launch

-Total Target Investar Token Distribution: 20% of the total supply (200,000,000 tokens)

-At the end of each month, Investar tokens are distributed to members based on the total token allocation and star weighting

-Star weighting is dynamically determined based on the individual's accumulated stars ratio to the total accumulated stars in each category

As Investar continues to innovate and grow within the ecosystem, we aim to unlock new opportunities for our members while driving the broader adoption of Web3 principles.

Investar aims to broaden its investment horizons by venturing into Real World Asset (RWA) projects, leveraging the expertise and interests of its diverse member base. RWA projects involve the tokenization of real-world assets such as real estate, commodities, and other tangible assets, providing investors with exposure to traditional markets within the realm of decentralized finance (DeFi). This strategic expansion aligns with Investar's mission to empower its community members with access to innovative investment opportunities while maintaining a commitment to decentralization and transparency.

We intend to launch decentralized index funds that provide exposure to curated portfolios of various assets. These index funds will be governed by the community, enabling members to propose, vote on, and manage various thematic indices tailored to different investment strategies and market trends. Through decentralized governance and transparent portfolio management, Investar aims to democratize access to diversified investment opportunities for all members.